Multi-generational Housing and the Accessory Dwelling Units (ADU) Connection

Do you remember the “Golden Girls” TV show where the unrelated, older roommates lived together at the show’s start date in 1985? Fast forward to today, and home sharing is no longer the fictional television sitcom but is approaching close to a million+ households with the 65 and older crowd.

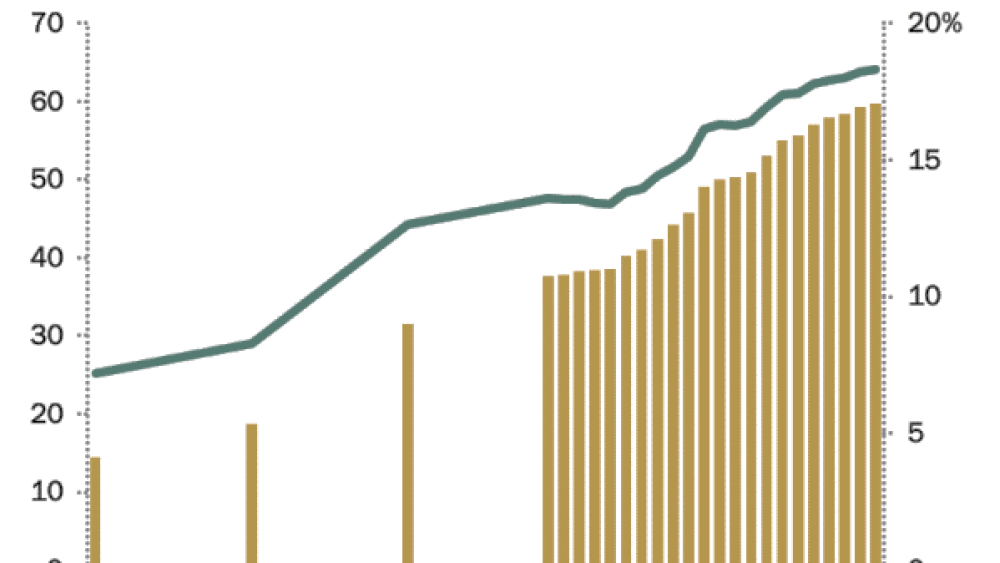

Today it is more along the lines of the multi-generational family households and it has been on the rise since the 1970s when this group numbered 14.5 million compared with 2021’s 59.7 million.

What Is a Multi-generational?

Multi-generational households are defined as including two or more adult generations or a “skipped generation,” which consists of grandparents and their grandchildren younger than 25. Most consist of at least two adult generations – for example, young adults living with their parents, parents residing in their adult children homes, or a grandparent, adult child, and adult grandchild under one roof.

Among the oldest Americans – ages 65 and up – 20% of women live in multi-generational households, compared with 15% of men. Older Americans are less likely to live alone than they were several decades ago, a change linked to the growing share of older women who live with their spouse or children.

Finding and affording housing is a common struggle for the older population - a third of those aged 50 and older pay more than 30% of their income on housing. This percentage is substantial considering that 40% of individuals 65 and older rely solely on Social Security for income, as documented by the National Institute on Retirement Security.

Multi-generational households can have financial advantages as they appear to offer protection against falling into poverty. The pooling of financial resources means that family helps in hard times, according to census data. The sharpest difference was for adults ages 85 and older. Among this group, 8% in multi-generational households lived in poverty, compared with 13% of those in other types of homes.

It may be of value for the group to become well informed of the Lifestyle Mortgage (HECM 4HP) available for those who are 62 years or older. The major benefit being, you obtain a mortgage that has deferred monthly mortgage payments allowing you to hold onto your home and have more cash flow among other benefits. Check Here for Criteria